Party Gaming PLC Announce Return To US Market

Party Gaming PLC Announce Return To US Market

London, England – 1st April, 2010 – Party Gaming PLC have today announced their return to the US market, anticipating all gaming verticals would be accepting real-money play from US players by June 15th, 2010.

Rod Perry, Party Gaming’s Non-Executive Chairman, welcomed the news but stressed that significant operational and logistical challenges lie ahead.

“We welcome the review of global trade law which has clearly shown the US to be acting illegally under international law in their attempts to block financial transactions to eGaming sites” said Mr Perry from London yesterday. “Party Gaming anticipate an aggressive return to the US Market starting immediately, with the near-term goal of regaining or aquiring the number #1 position in all of the gaming verticals we cover.”

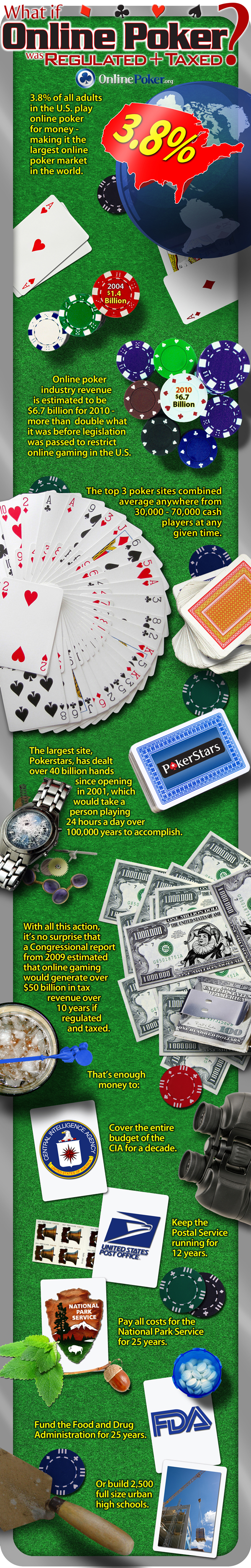

If you are lucky enough to win, you will have to share your online gambling profits with Uncle Sam, and depending on how often you play, you might want to think about keeping a log of your yearly gambling history. Because if you lose a few rounds, there is a way you can turn those losses into a tax advantage when it comes time to file.

If you are lucky enough to win, you will have to share your online gambling profits with Uncle Sam, and depending on how often you play, you might want to think about keeping a log of your yearly gambling history. Because if you lose a few rounds, there is a way you can turn those losses into a tax advantage when it comes time to file.

Let’s look at the federal tax forms you’ll need to share your good fortune with the Internal Revenue Service.

Winning Amounts Matter

Requirements and withholdings from a winning bet depend on the type of gambling, the amount won, and the ratio of winnings to the wager. When you pocket $600 or more (and that amount is 300 times your bet) at a horse track, win $1,200 at a slot machine, or take $1,500+ in keno winnings, the payer must get your Social Security Number and notify the IRS that you came into said extra income. And while poker fans argue that their card game isn’t technically gambling because it’s based on a game of skill, the IRS still wants details on how well you played Texas Hold ‘em.

If you are not a bank, it is legal for you to participate in the transferring of funds online and the activity of online poker. You may play, at least for the next six months…

If you are not a bank, it is legal for you to participate in the transferring of funds online and the activity of online poker. You may play, at least for the next six months…

The UIGEA’s regulations that were suppose to take effect on December 1st, 2009 have been delayed six months to June 1, 2010.

Banks had begun preparing to comply with all UIGEA regulations and poker players were looking to Barney Frank with watchful expectancy. Although the Chairman of the House Financial Services Committee is not a gambler himself, he believes the government should not tell its citizens how they should spend their money. Early in December, 2009, Representative Frank and the PPA (Poker Players Alliance), the leading poker grassroots advocacy group with more than one million members nationwide, were successful in getting Treasury Secretary Timothy Geithner and Federal Reserve Chairman Ben S. Bernake to postpone the deadline and give them the necessary time for more research into online gaming. It is with hope that the federal government will move to explicitly legalize and regulate the game. The new bill would create an exemption to the Unlawful Internet Gambling Enforcement Act for operators that are licensed and regulated.

This is a big win for poker, but an even greater victory for advocates of good and fair public policy. In the months to come, legislators will be able to interpret UIGEA and pass legislation and regulate poker in the year 2010. There is concern, though, about unclear language contained in the UIGEA and the resulting doubts of enforcing the law by banks and gambling communities. Several banks and financial service groups have expressed their support for a better written law which will enable them to comply with the Federal Reserve and Department of Treasury.

7 Comments - Click Here to Speak Up